Highlights

- Peru’s CV19 cases needs to stay undercontrol

- Iquitos is slightly concerning

- Mining and Hydrocarbon industry is preparing back to work (in my opinion) by lowering the health condition requirements for workers

- RANDOM: Are the shale zombies reviving?

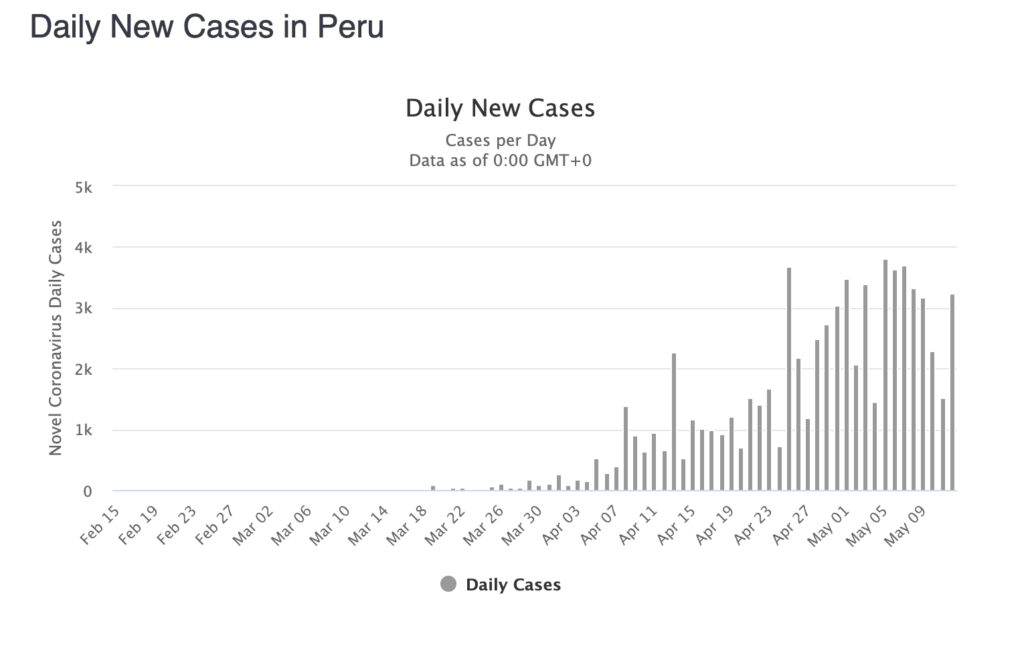

Peru’s CV19 cases curve look “meh”

I think it’ll take a month at least for Peru to stabilize from CV19.

Energy Transfer claims shale producers are turning back on production.

“Oil producers have generally been vague about when they’ll ramp output back up, though some have hinted that oil prices in the high-$20s or low-$30s could be sufficient. “

Iquitos not looking good at the moment: “Iquitos regional hospital: 11 doctors for 600 patients“

“Protocol modified so that workers can work in the reactivation of mining, energy and hydrocarbons”

“According to Ministerial Resolution No. 135-2020-MINEM-DM , it is established that from now on, workers over 65 years of age and those with a BMI of 40 and over will be considered as part of the risk group. With this, the age limit will no longer be from 60, nor the BMI from 30 to more”