I would listen to this.

Tag: O&G

Art Berman’s podcast on oil

I spent an hour of my evening listening to Art. Definitely recommend!

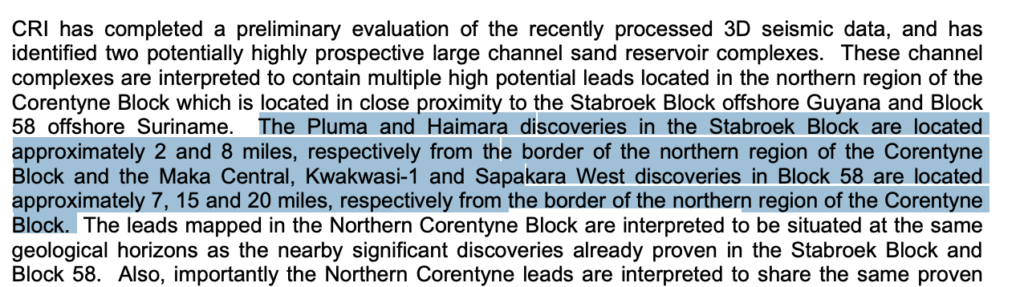

Frontier’s Guyana Prospects through CGX Energy

Corentyne block leads are very close to discoveries such as Pluma and Haimara. In the map below, areas in green are oil discoveries, and areas in red are gas discoveries.

Let’s Dive Deep.

Pluma

ExxonMobil’s run of success continued with its 10th Guyana discovery on 3 December 2018. The Pluma-1 well found 121 feet (37 meters) of oil-bearing sandstone, on trend with other discoveries in Guyana’s Cretaceous sandstone play. The discovery, along with appraisals, adds 1 billion barrels of oil equivalent (boe) of discovered resources.

Pluma is located 42 miles (67 kilometres) southeast of Liza, and Wood Mackenzie estimates the discovery holds 300 million barrels of oil equivalent (mmboe) of recoverable resources,

source: https://www.woodmac.com/press-releases/ExxonMobil-Pluma-Discovery/

Haimara

The other discovery was at the Haimara-1 well, which encountered approximately 207 feet (63 meters) of high-quality, gas-condensate bearing sandstone reservoir. The well was drilled to a depth of 18,289 feet (5,575 meters) in 4,590 feet (1,399 meters) of water. It is located approximately 19 miles (31 kilometers) east of the Pluma-1 discovery and is a potential new area for development.

source: https://corporate.exxonmobil.com/News/Newsroom/News-releases/2019/0206_ExxonMobil-Announces-Two-New-Discoveries-Offshore-Guyana

Maka

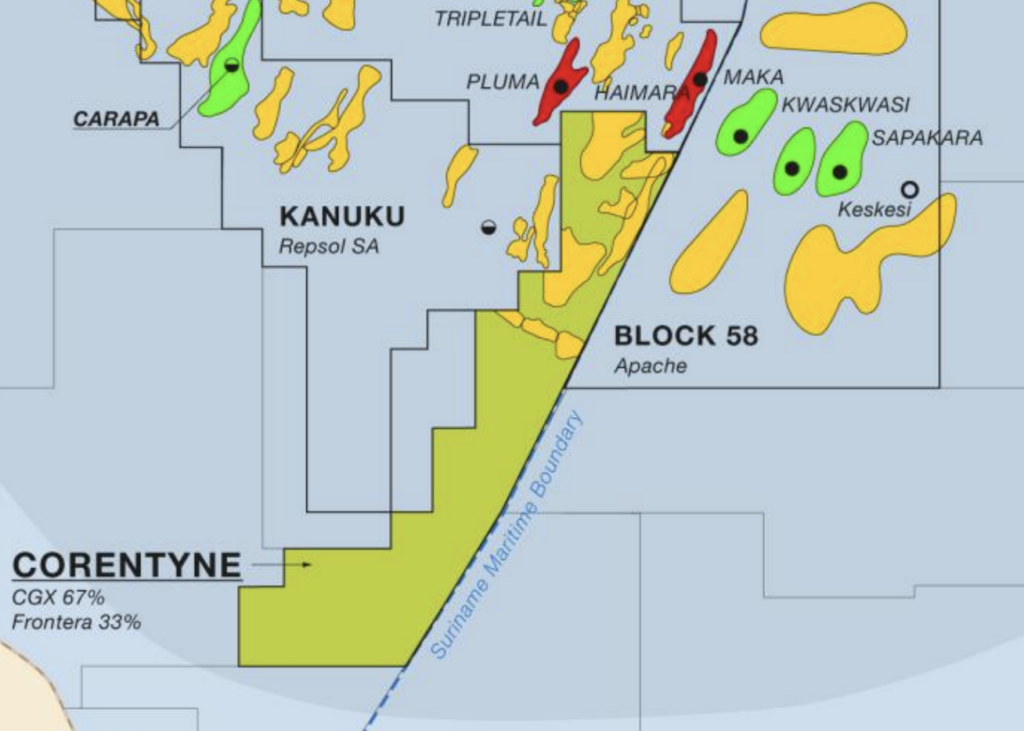

The Maka Central-1 well was drilled by a water depth of about 1,000 meters and encountered more than 123 meters net pay of high-quality light oil and gas rich condensate net pay, in multiple stacked reservoirs in Upper Cretaceous Campanian and Santonian formations.

source: https://www.total.com/media/news/press-releases/suriname-total-and-apache-make-significant-discovery-block-58

WoodMac has said based on its estimate Maka Central-1 contains 300 million barrels of oil, 150 million barrels of condensate and 1.4 trillion cubic feet of gas. According to a report from GlobalData, the discovery has the potential to bring more than US$50 million in revenue per year to the Surinamese Government if it sees similar success to Guyana’s Stabroek Block.

source: https://oilnow.gy/featured/apache-gets-discovery-of-the-year-award-for-surinames-maka-central-oil-strike/

Sapakara

The Sapakara West-1 well was drilled by Apache using the Noble Sam Croft drillship in a water depth of 1,000 metres and encountered a 79 metre net pay of high quality light oil and gas condensate in multiple stacked and good quality reservoirs in Upper Cretaceous Campanian and Santonian formations.

According to Apache, the preliminary fluid samples and test results indicate at least 79 metres of net oil and gas condensate pay in two intervals. The shallower Campanian interval contains 13 metres of net gas condensate and 30 metres of net oil pay, with API oil gravities between 35 and 40 degrees. The deeper Santonian interval contains 36 metres of net oil-bearing reservoir with API oil gravities between 40 and 45 degrees

source: https://www.fircroft.com/blogs/apache-and-total-announce-new-suriname-oil-discovery-09431241377

Kwaskwasi

Kwaskwasi-1 encountered at least 912 feet (278 meters) of net oil and volatile oil/gas condensate pay across two intervals – Campanian – 282 feet (63 meters) of net oil pay and 86 meters of net volatile oil/gas condensate pay, and Santonian – 129 meters of net hydrocarbon pay.

source: https://oilnow.gy/featured/liza-and-kwaskwasi-are-giants-in-the-prolific-guyana-suriname-basin/

If CGX hit a net pay anywhere close to Kwaskwasi’s scale, it would be incredible.

source: https://oilnow.gy/featured/liza-and-kwaskwasi-are-giants-in-the-prolific-guyana-suriname-basin/

Oil Supply and Demand 2020 – 2021 (Part 1)

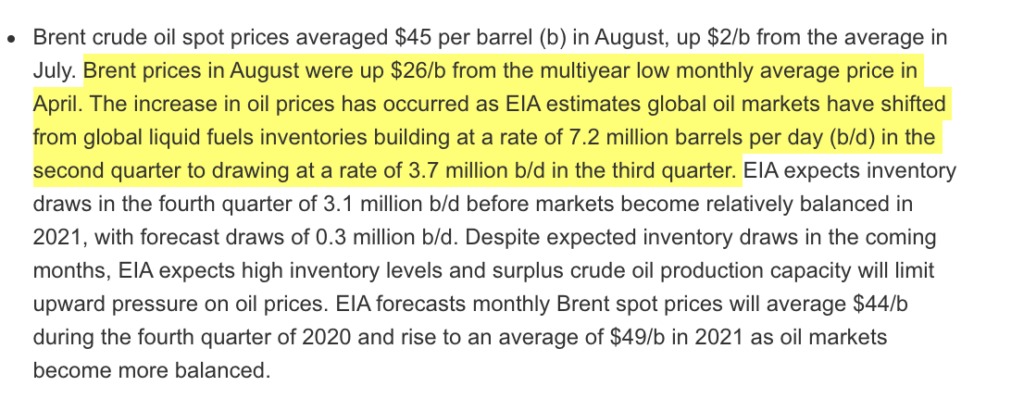

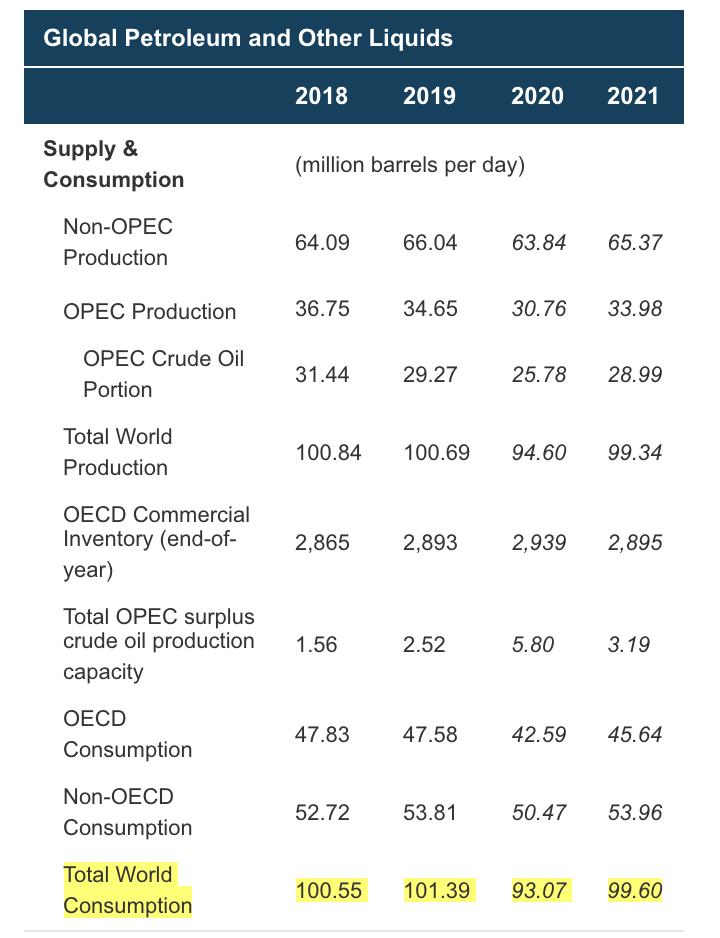

As speculator, I’ve been very curious on how much production cut is in place, how much excess inventory still exists, and when will oil demand pick up again? Ultimately, I want to know when will an oil bull market return? Therefore, I started digging into production and demand data from EIA. I’ll definitely look into other data source in a bit. Okay, let’s get started

The OPEC+ alliance has 2.375 million b/d of so-called “compensation cuts” due to make up for previous overproduction in violation of quotas, but not all members have submitted plans to implement the extra reductions, according to an internal document seen by S&P Global Platts.

“OPEC and 10 allies, including Russia, are in the midst of a historic production cut accord aimed at helping the oil market recover from the COVID-19 pandemic. The curbs initially started at 9.7 million b/d for May-July, before tapering to 7.7 million b/d from August through the end of the year.

This means 7.7 + 2.375 = 10.375 million bopd cut until end of year

Oil production from the US lower 48 states, excluding Gulf of Mexico, peaked at 9.2 million barrels per day in August following back-to-back increases since June. This climb has helped push the nationwide total above 11 million bpd and is likely to keep it above that mark for the rest of the year, according to Rystad Energy estimates.

source: https://www.spglobal.com/platts/en/market-insights/latest-news/oil/100120-opec-has-2375-mil-bd-of-compensation-cuts-due-through-end-2020-document

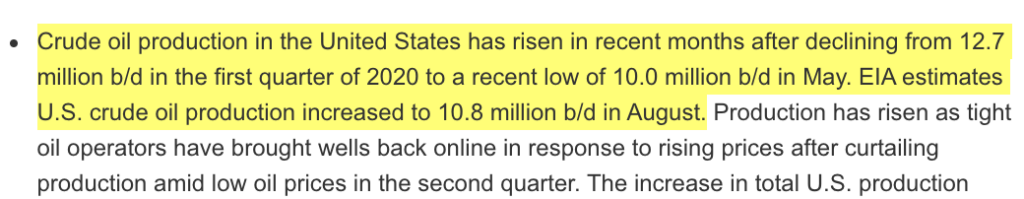

US Production Cut is approximate at ~2 million bopd right not according to the EIA.

Hence, I’m guessing total global production cut is approximately 12 million bopd in Oct 2020. Let’s calculate the surplus. 7.2 million bopd * 1Q * 90 days/Q = 648 million barrels of surplus.

At 3.7 million bopd draw rate in Q3, and 3.1 in Q4, let’s do some calculations.

3.7 mbop/day * 90day + 3.1 mbop/day * 90day = 333 mbo + 279 mbo = 612 million barrels of oil

This means by Q1 2021, we are expecting a rebalance of supply and demand.

But wait, not so fast, what about supply capacity? As demand returns, wouldn’t supply return as well? EIA forecasts world consumption will be 99.6 mbopd, meaning demand will return to pre-covid level. I’m not 100% confident that this will happen. Eventually the population will have to live with covid 19 regardless of a vaccine and I personally am not optimistic a vaccine will be widely distributed until end of 2021 at the very least unfortunately; thus, I would put a discount on the forecast, say 5%. Air travel will still be a problem, so once I determine how much jet fuel contributes to over all oil consumption, I can apply jet fuel discount. But for now, my expectations for oil consumption in 2021 is ~94 mopd.

Anyway, with oil companies reducing capex globally, will we have enough surplus capacity to meet demands beyond 2020? That is my next action item.

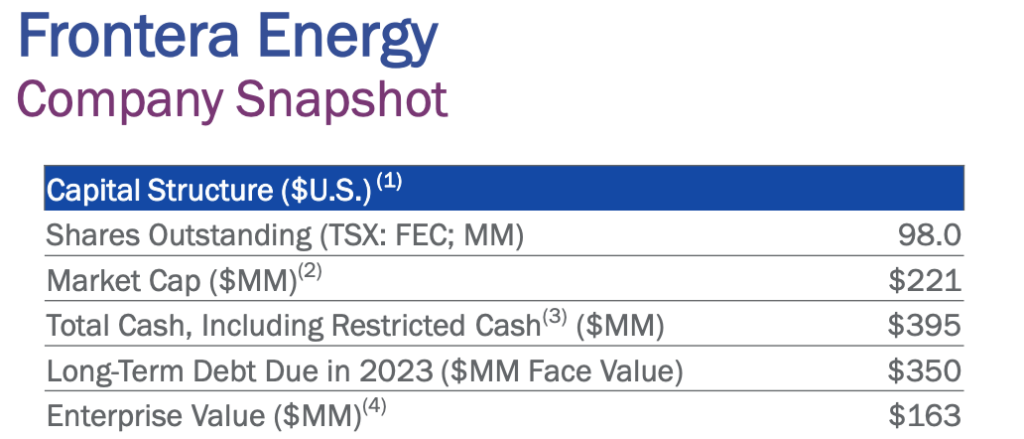

Frontera breakdown and things that matter

Cash

source: http://www.fronteraenergy.ca/content/uploads/2020/09/September-2020-Corporate-Presentation-2Q2020.pdf

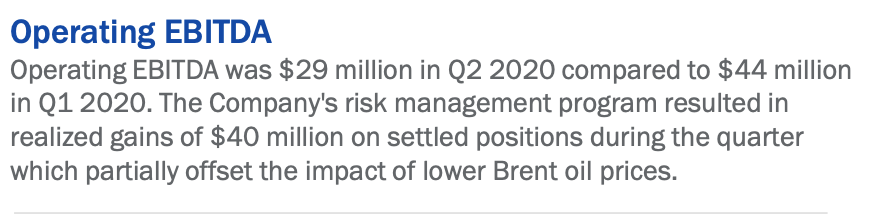

Oil production

Let’s skip this for now; there’s a lot of operating loss from low oil prices. From Frontera’s Q2 presentation MD&A, here’s a snapshot.

The net loss was primarily caused by the operating loss of $79.9 million which was driven by lower oil price

realizations from lower production.

source: http://www.fronteraenergy.ca/content/uploads/2020/09/September-2020-Corporate-Presentation-2Q2020.pdf

Exploration

- Guyana Offshore Assets

Infrastructure Assets

- ODL $22.3 million USD for six months ended in June

- BIC $17.0 million USD for six months ended in June

- Puerto Bahía

For the six months ended June 30, 2020, the Company recognized $22.3 million as its share of income from ODL which was $6.2

million lower than the same period of 2019 primarily due to a decrease in the transportation tariff in 2020 and the impact of foreign

exchange fluctuations. During the six months ended June 30, 2020, the Company recognized gross dividends of $24.5 million which

were declared and paid by ODL.

For the six months

ended June 30, 2020, the Company recognized its share of dividends declared by Bicentenario totalling $17.0 million. As at June 30,

2020, the carrying value of dividends receivable from Bicentenario on a discounted basis was $49.7 million ($56.6 million

undiscounted).

source: http://www.fronteraenergy.ca/content/uploads/2020/08/MDA-Frontera-Q2-2020-2.pdf

Thoughts:

Is the company really worth $228.41M CAD (today’s market cap)? NO – they are worth more. I have no idea why there are 9 million shorts. Something seems fishy, but I’ll be buying and buying…