As speculator, I’ve been very curious on how much production cut is in place, how much excess inventory still exists, and when will oil demand pick up again? Ultimately, I want to know when will an oil bull market return? Therefore, I started digging into production and demand data from EIA. I’ll definitely look into other data source in a bit. Okay, let’s get started

The OPEC+ alliance has 2.375 million b/d of so-called “compensation cuts” due to make up for previous overproduction in violation of quotas, but not all members have submitted plans to implement the extra reductions, according to an internal document seen by S&P Global Platts.

“OPEC and 10 allies, including Russia, are in the midst of a historic production cut accord aimed at helping the oil market recover from the COVID-19 pandemic. The curbs initially started at 9.7 million b/d for May-July, before tapering to 7.7 million b/d from August through the end of the year.

This means 7.7 + 2.375 = 10.375 million bopd cut until end of year

Oil production from the US lower 48 states, excluding Gulf of Mexico, peaked at 9.2 million barrels per day in August following back-to-back increases since June. This climb has helped push the nationwide total above 11 million bpd and is likely to keep it above that mark for the rest of the year, according to Rystad Energy estimates.

source: https://www.spglobal.com/platts/en/market-insights/latest-news/oil/100120-opec-has-2375-mil-bd-of-compensation-cuts-due-through-end-2020-document

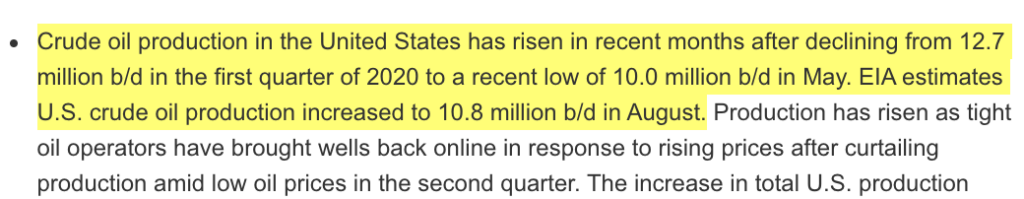

US Production Cut is approximate at ~2 million bopd right not according to the EIA.

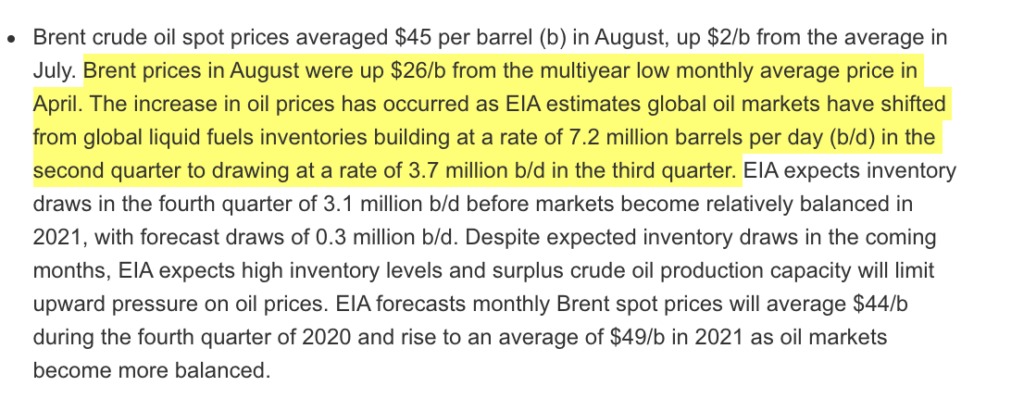

Hence, I’m guessing total global production cut is approximately 12 million bopd in Oct 2020. Let’s calculate the surplus. 7.2 million bopd * 1Q * 90 days/Q = 648 million barrels of surplus.

At 3.7 million bopd draw rate in Q3, and 3.1 in Q4, let’s do some calculations.

3.7 mbop/day * 90day + 3.1 mbop/day * 90day = 333 mbo + 279 mbo = 612 million barrels of oil

This means by Q1 2021, we are expecting a rebalance of supply and demand.

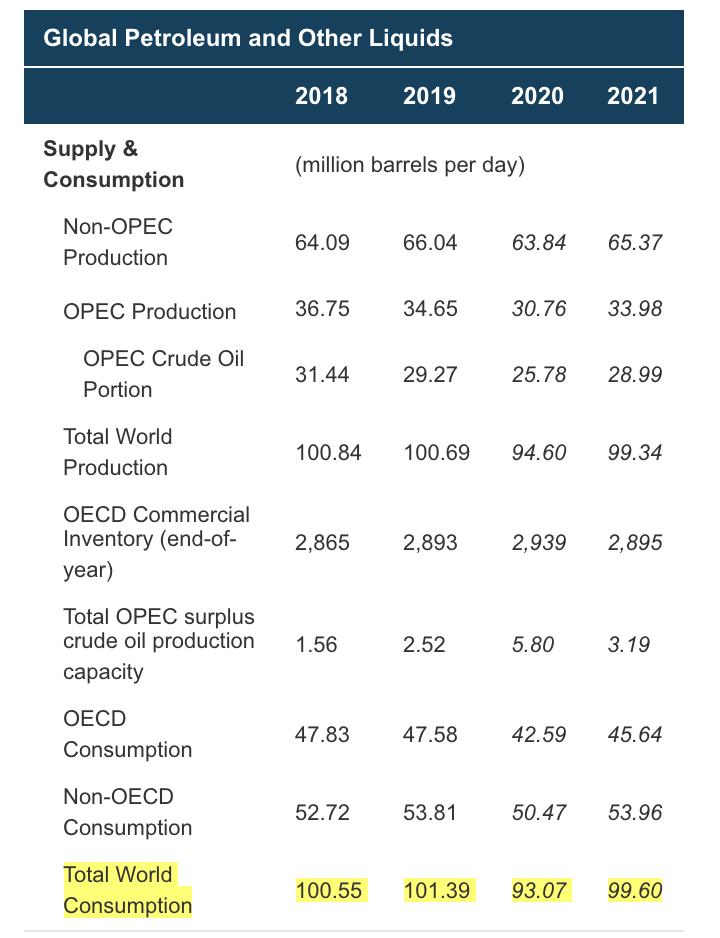

But wait, not so fast, what about supply capacity? As demand returns, wouldn’t supply return as well? EIA forecasts world consumption will be 99.6 mbopd, meaning demand will return to pre-covid level. I’m not 100% confident that this will happen. Eventually the population will have to live with covid 19 regardless of a vaccine and I personally am not optimistic a vaccine will be widely distributed until end of 2021 at the very least unfortunately; thus, I would put a discount on the forecast, say 5%. Air travel will still be a problem, so once I determine how much jet fuel contributes to over all oil consumption, I can apply jet fuel discount. But for now, my expectations for oil consumption in 2021 is ~94 mopd.

Anyway, with oil companies reducing capex globally, will we have enough surplus capacity to meet demands beyond 2020? That is my next action item.