Frontera Energy (FEC)

Buybacks – Approximately 10% of float

Frontera believes that, from time to time, the market price of its Common Shares may not fully reflect the underlying value of its business and future prospects and financial position

This will keep FEC’s share prices up, used for future strategic plans.

Reserve replacement

Frontera delivered 154% 2P reserves replacement, added 24.8 MMboe of 2P net reserves and extended its reserve life index

to 10.3 years at year end 2020.

Sneaky acquisition plans

Puerto Bahia

On December 30, 2020, the Company further increased its ownership to 94.12% through the conversion of certain debt into preferred shares with voting rights.

Frontera now owns 94%.12 of Puerto Bahia now and since that acquisition, Puerto Bahia generated $13.8 million dollars of segment income. I expect 2021 to be even greater.

Since the acquisition of control, Puerto Bahia has generated $13.8 million of segment operating income primarily from take-or-pay contracts in its liquid bulk storage terminal business.

As at December 31, 2020, the 2025 Puerto Bahia Debt outstanding amount is $183.1 million.

source: https://www.fronteraenergy.ca/content/uploads/2021/03/MDA-FY-20-SEDAR.pdf

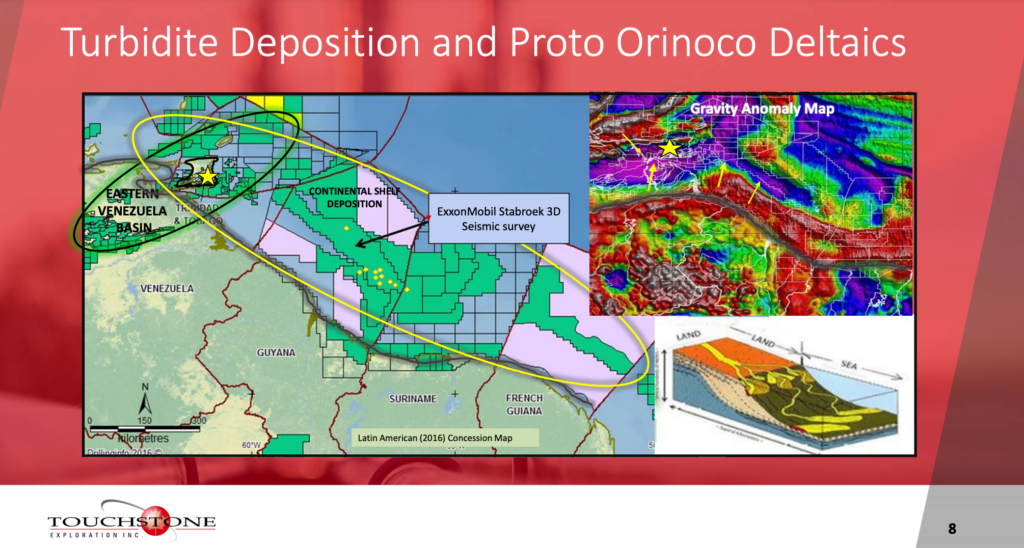

CGX Energy

Frontera basically run CGX Energy. They are going to acquire CGX Energy one way or another. With Guyana being such a hot place for offshore drilling. CGX is an excellent entry into Guyana.

Both blocks will have oil, FEC/CGX just needs to execute.

source: https://www.fronteraenergy.ca/content/uploads/2021/03/MDA-FY-20-SEDAR.pdf