My notes

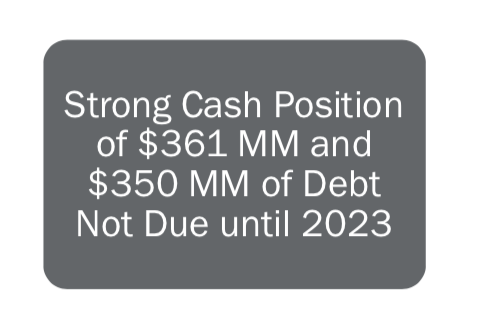

- Cash > Debt by $10MM USD

- Cashflow from Oil and Mid Stream

- Cost of oil approximately $25/bbl USD

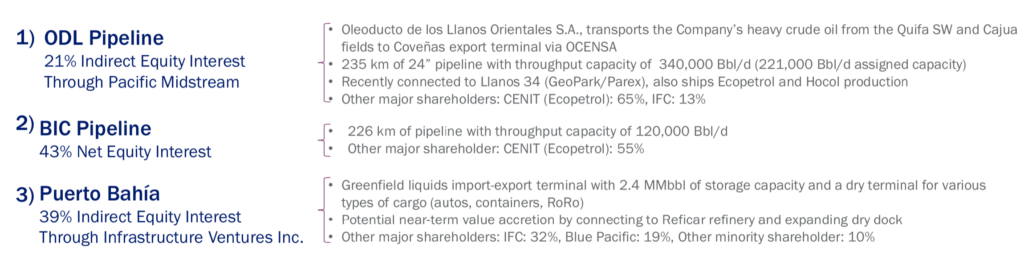

- Midstream Infrastructure is a little bit messy to me

- Book Value of Infrastructure investment = ~260MM USD

- attack risks

- commitments to finance infrastructure

- note: I want to discount all infrastructure value until I get more clarity

- 15MM USD Dividend Policy Quarterly when Brent >$60/bbl

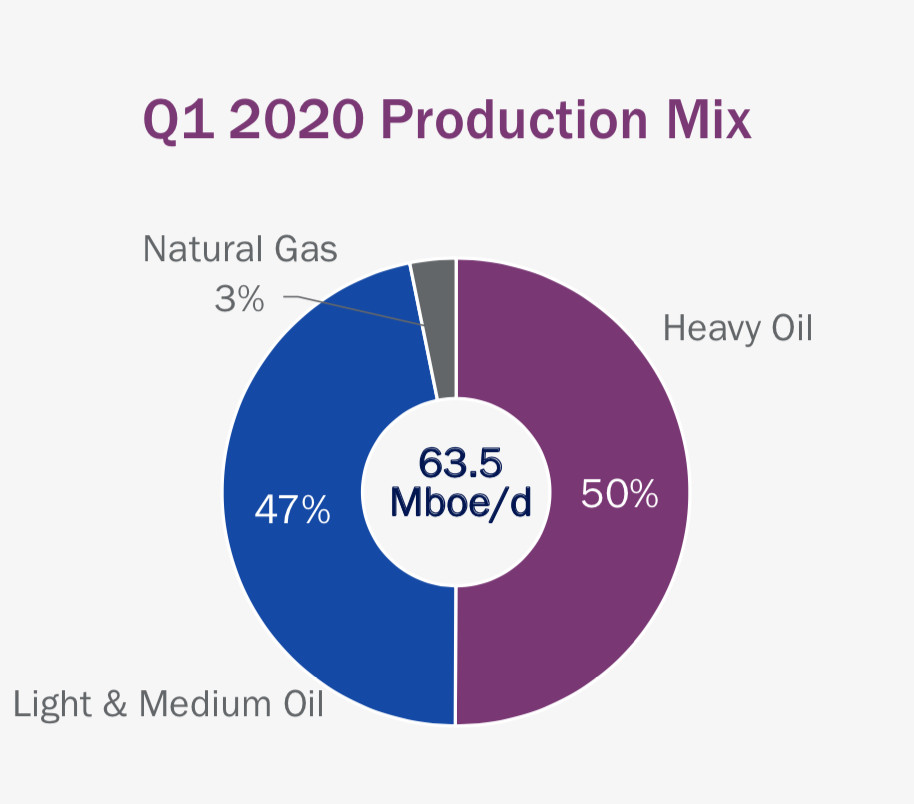

Oil

2P Reserves 2019

158 MMBOE

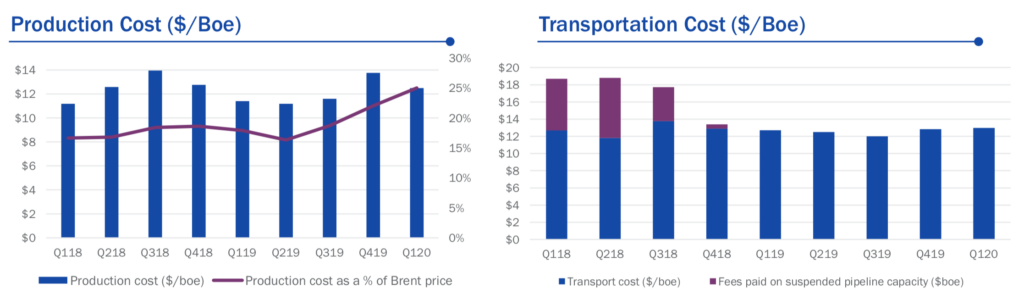

Cost of Production and Transportation

~$25/bbl USD

Hedged

2020 Q1 Netback

Dividends

Debt

Infrastructure

Tax Loss

The savings made by FEC virtually all

flow straight through to cash flow because of the large tax loss position in excess

of US$3bn.

source: Hannam & Partners Equity Research 7/9/2019

Risks

Emerged from Bankruptcy

The company is just starting to reap the rewards from intense

restructuring after bankruptcy in 2016.

source: Hannam & Partners Equity Research 7/9/2019

Pacific Rubiales bankruptcy

Pipeline Liabilities

Pipeline Attacks: numerous attacks on pipelines

BIC appears to be a liability, but is resolved.