Cash

source: http://www.fronteraenergy.ca/content/uploads/2020/09/September-2020-Corporate-Presentation-2Q2020.pdf

Oil production

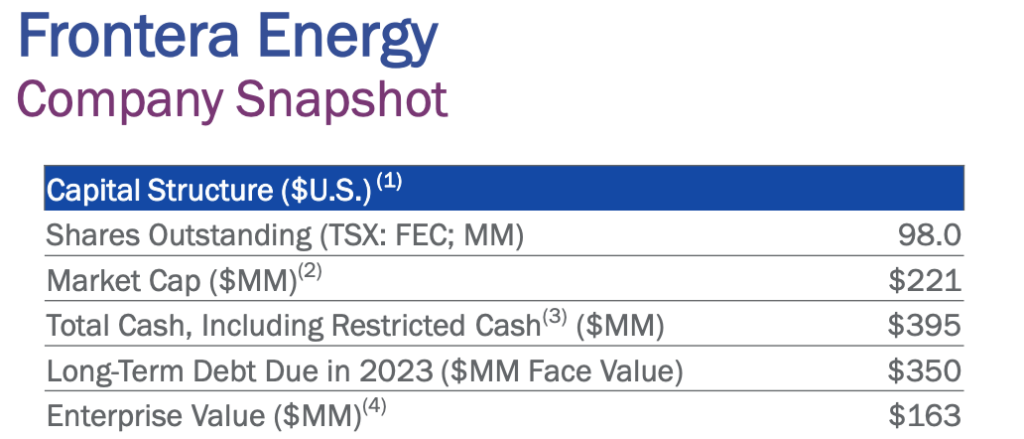

Let’s skip this for now; there’s a lot of operating loss from low oil prices. From Frontera’s Q2 presentation MD&A, here’s a snapshot.

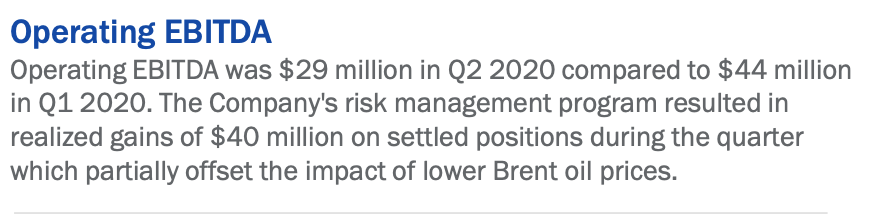

The net loss was primarily caused by the operating loss of $79.9 million which was driven by lower oil price

realizations from lower production.

source: http://www.fronteraenergy.ca/content/uploads/2020/09/September-2020-Corporate-Presentation-2Q2020.pdf

Exploration

- Guyana Offshore Assets

Infrastructure Assets

- ODL $22.3 million USD for six months ended in June

- BIC $17.0 million USD for six months ended in June

- Puerto Bahía

For the six months ended June 30, 2020, the Company recognized $22.3 million as its share of income from ODL which was $6.2

million lower than the same period of 2019 primarily due to a decrease in the transportation tariff in 2020 and the impact of foreign

exchange fluctuations. During the six months ended June 30, 2020, the Company recognized gross dividends of $24.5 million which

were declared and paid by ODL.

For the six months

ended June 30, 2020, the Company recognized its share of dividends declared by Bicentenario totalling $17.0 million. As at June 30,

2020, the carrying value of dividends receivable from Bicentenario on a discounted basis was $49.7 million ($56.6 million

undiscounted).

source: http://www.fronteraenergy.ca/content/uploads/2020/08/MDA-Frontera-Q2-2020-2.pdf

Thoughts:

Is the company really worth $228.41M CAD (today’s market cap)? NO – they are worth more. I have no idea why there are 9 million shorts. Something seems fishy, but I’ll be buying and buying…