FEC will be issuing $400 million in senior unsecured notes due 2028 at a coupon rate of 7.875% and buying back their $350 million worth of 2023 9.70% senior secured notes at 104.95% premium. This indicates a 1.825% difference in interest payments.

I believe there will be associated costs to pay any financings fees and the 4.95% premium on existing bonds; though the impact will be short lived. The long term benefit would be $2.45 million/annum in interest savings since the loan is now $400 million.

Bigger loan, smaller interest payment, why not?

The reduction in financing cost is a sound move, but the interesting part is this shows rating agencies believe Frontera is a lower risk investment than it was a year ago.

The 2028 Notes have been assigned a rating of B+ by S&P Global Ratings with a Stable Outlook and a rating of B with a Stable Outlook by Fitch Ratings.*

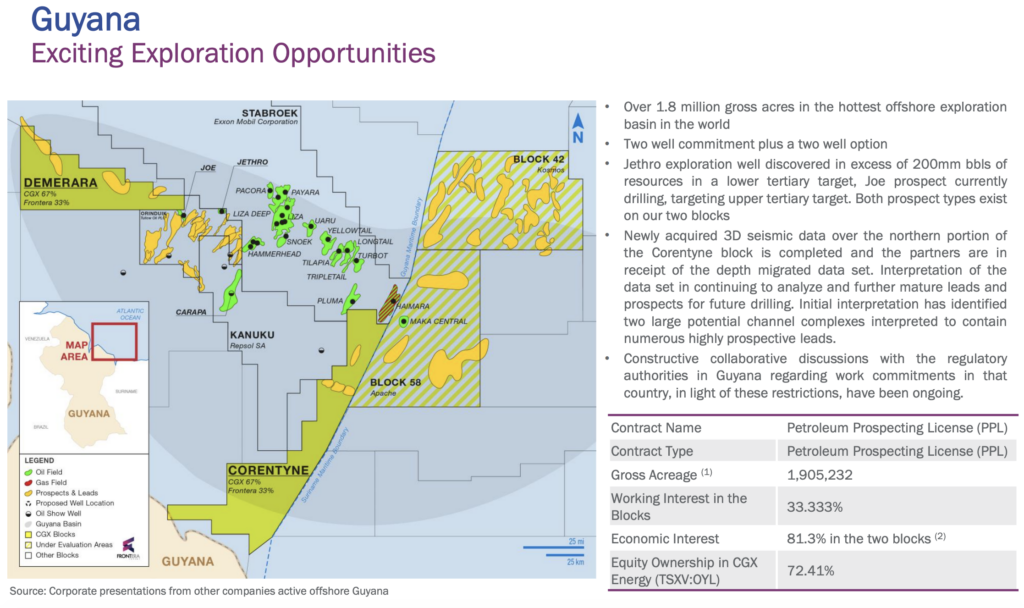

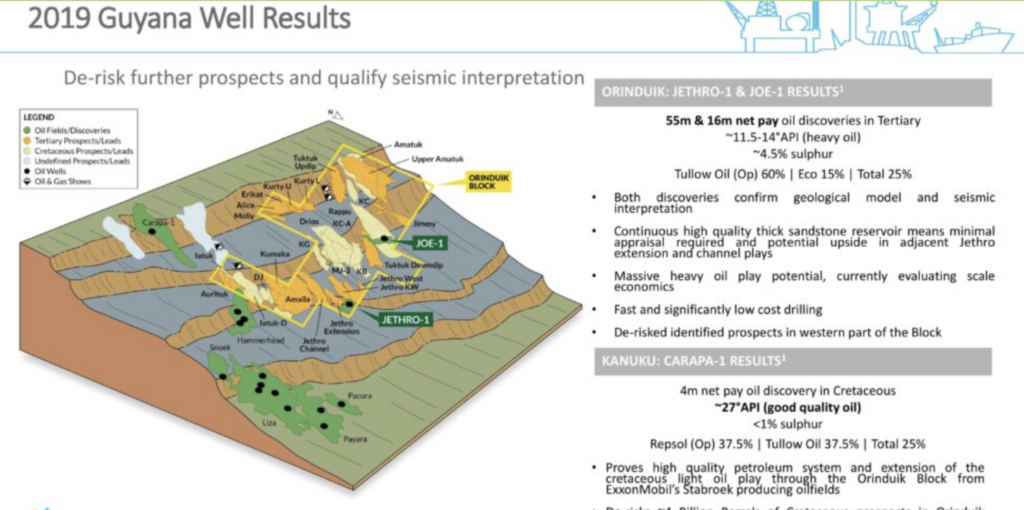

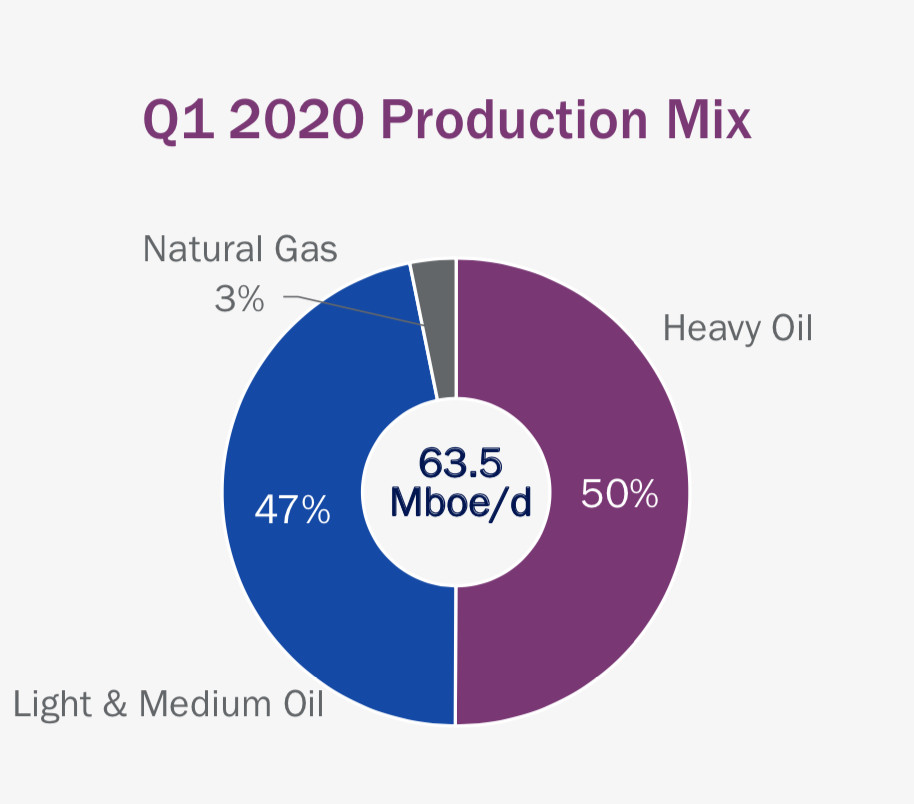

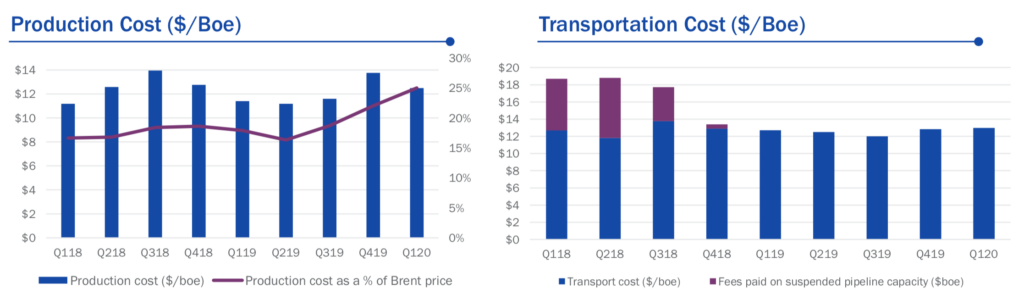

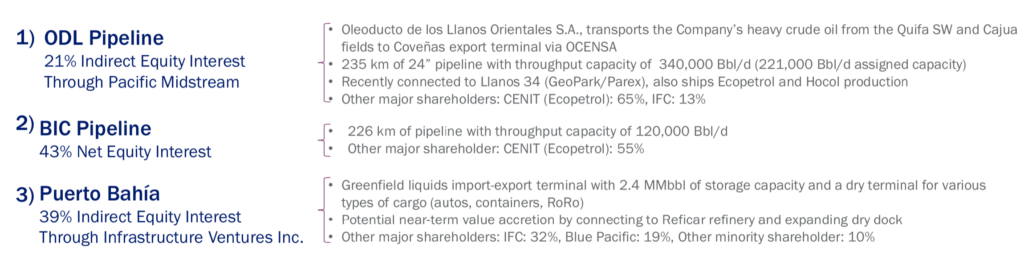

With an even stronger balancing sheet, Frontera is poised to take on Guyana, the elephant in the room, and Puerto Bahia, the giraffe in the room – meanwhile taking advantage of its strong production at $70 oil prices.

I do wonder what Frontera is going to do with the extra $50 million dollars; save it for a rainy say? Continue to develop Guyana upon initial drilling success; or take Puerto Bahia to profitability?

source: https://fronteraenergy.mediaroom.com/2021-06-10-Frontera-Prices-Oversubscribed-and-Upsized-US-400-Million-Senior-Unsecured-Notes-Offering-at-7-875