Jamaica and Egypt – that’s all I care about, rest are just icing.

UOG is will be cashed up for any oil price instability and crisis

- Cashflow from Egypt: net ~$6.9M for 2020

- Crown divestment – net ~$2.85M for 2020

Egypt

I’m assuming UOG can recover all 30% of recovery oil because they have a large tax pool. All calculations are in USD.

- Production: 1850 bopd

- OPEX: $6.50

- Brent Discount: 5%

- Brent Price: $32

- Annual profit: $6957028.16

- Daily Revenue: $56240.0

- Annual Revenue: $20527600.0

I used a python script to do my calculation and here is my formula, do let me know if my formula is flawed:

daily_profit = (bopd * ((brent_price – current_opex) * (1 – brent_discount))) * 0.3 + 0.7 * 0.179* (bopd * (brent_price – current_opex) * ( 1 – brent_discount) )

Egypt PSC Terms

Caveats

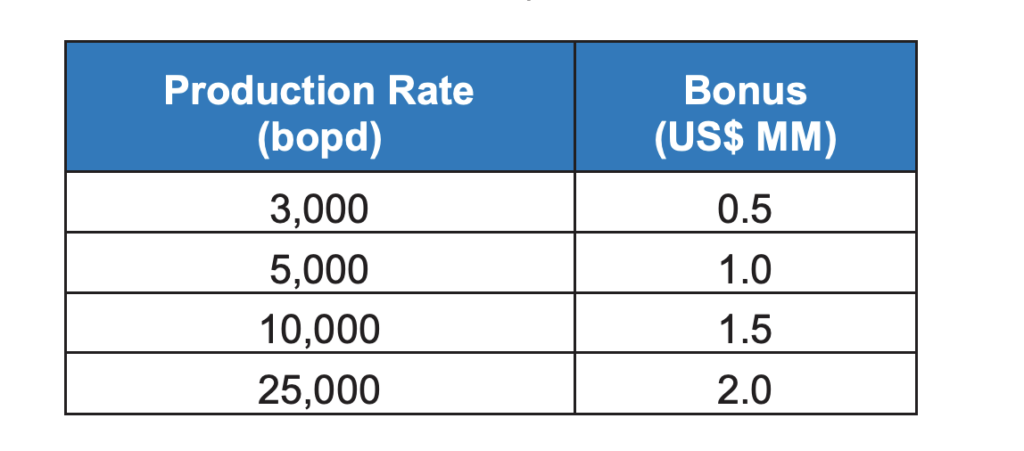

- bonus payments required on different tiers of production level

From AIM Admission document

Cost Recovery and Production Sharing

“The Contractors will recover quarterly all costs in respect of exploration, development and operation

out of 30 per cent. of all petroleum produced within the concession area. To the extent that the value

of such cost recovery petroleum exceeds the actual recoverable costs, the value of the excess cost

recovery petroleum will be divided between EGPC and the Contractors in accordance with the

percentages of production sharing as set out below.

The remaining 70 per cent. of the petroleum will be divided between EGPC and the Contractors as

follows:

EGPC’s share Contractors’ share

Crude Oil 82.1% 17.9%

Gas and LPG 82.1% 17.9%

With respect to the Contractors’ share of the crude oil produced, priority will be given to meet the

requirement of the Egyptian market for which EGPC has a preferential right to purchase. With respect

to the gas and liquefied petroleum gas produced, priority will be given to meet the requirement of

the local market as determined by EGPC. Where EGPC or EGAS is the buyer of the gas sold to the

local markets, the sale will be by virtue of a long term gas sales agreement to be entered into between

EGPC and the Contractors (as sellers) and EGPC or EGAS (as buyer).

Bonus Payment

The Abu Sennan Concession provides for certain bonus payments payable to EGPC by the

Contractors such as upon approval of each Development Lease and by the relevant Contractor in

the event of assignment of its rights and obligations under the Abu Sennan Concession (see below).

In addition, the Contractors are obliged to make certain production bonus payments to EGPC upon

production reaching certain agreed thresholds.“

source: https://www.uogplc.com/wp-content/uploads/2019/12/The-Company%E2%80%99s-Re-Admission-Document.pdf

Crown Divestment

“Under the terms of the Crown SPA, and subject to FDP approval, United expects a further $2.85m of net payments during 2020 from the sale of this asset.”

source: https://polaris.brighterir.com/public/united_oil_and_gas/news/rns/story/xqjey7w

Jamaica

“United has indicated to the Jamaican authorities that it wishes to explore options for continuing to progress what United believe to be a transformative licence. Discussions have been initiated with the Government, and we will update the market in due course.”

source: https://polaris.brighterir.com/public/united_oil_and_gas/news/rns/story/xqjey7w

contact: [email protected]