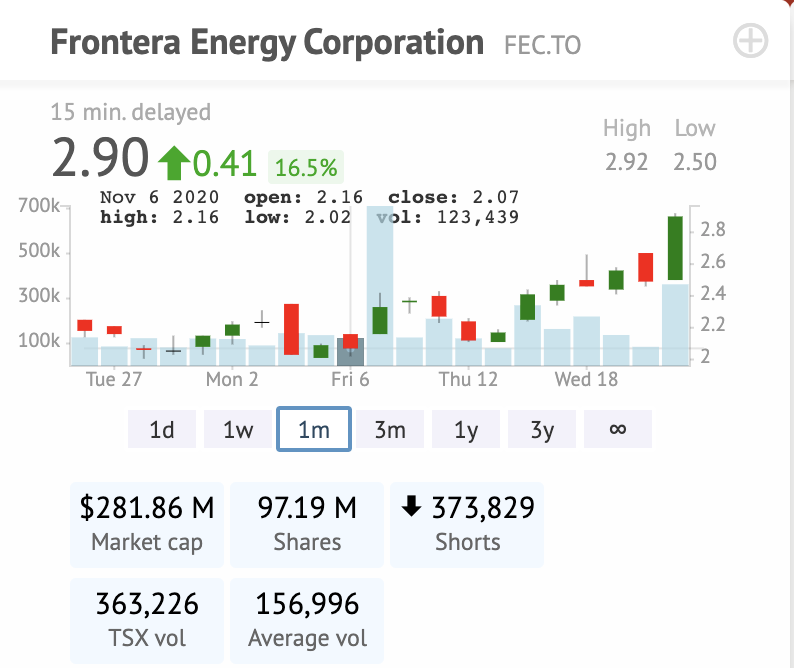

The oil market is in a tough spot right now. The recent price increase already has OPEC+ extending cuts priced in. If OPEC+ decides against extending cuts, oil prices will drop vertically. It will take months before excess oil inventory is removed and thereby delaying oil market rebalance.

Currently OPEC+ cannot agree on extending cuts beyond January, and this is spooking the market. I anticipate volatility in O&G equities until a consensus is made.

Thoughts

Reading from credible twitters and sources, with some analysis, I’ve listed several outcomes in the order of most likely to least likely.

- OPEC+ agrees to a partial extension of cuts

- OPEC+ does not extend cuts

- OPEC+ agrees to a full extension of cuts

If OPEC+ does not extend cuts, oil prices will drop likely back to $30s. Not good

If OPEC+ agrees to full cut, oil prices will increase such that production can be brought online. Not good either.

If OPEC+ agrees to a partial cut, oil prices may stay in a steady sweet spot such that excess inventory continues to decrease, and high cost producers cannot bring production back online.

I think I will buy the volatility because low cost producers will be just fine.