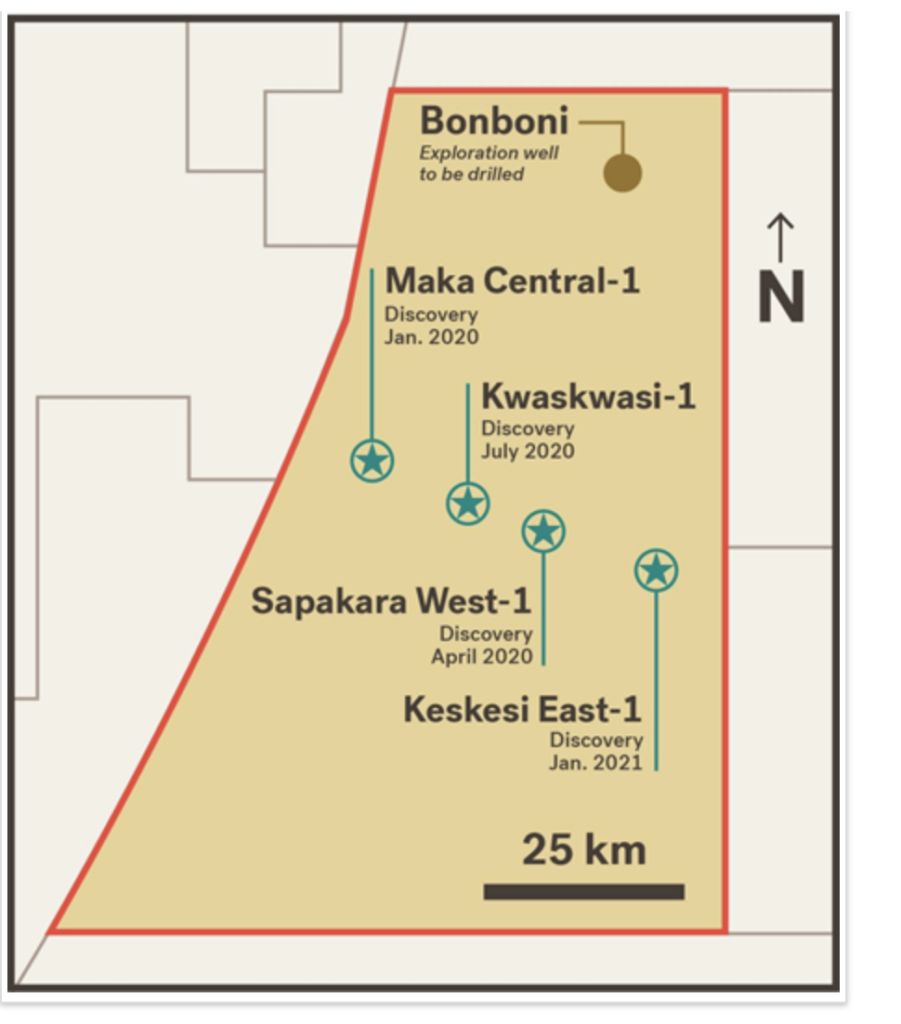

On Jan 14, 2021, Total and Apache announced the following

Keskesi East-1 encountered targets in the upper Cretaceous-aged Campanian and Santonian intervals. The shallower Campanian interval contains 58 meters (190 feet) of net oil, volatile oil and condensate pay and the Santonian interval contains 5 meters (16 feet) of net oil and volatile oil pay. Fluid samples indicate API oil gravities of approximately 27 to 28 degrees in the Campanian and 35 to 37 degrees in the Santonian. The Keskesi East-1 well is continuing to drill to deeper Neocomian-aged targets. Upon completion of operations at Keskesi East-1, the Noble Sam Croft drillship will be released as planned.

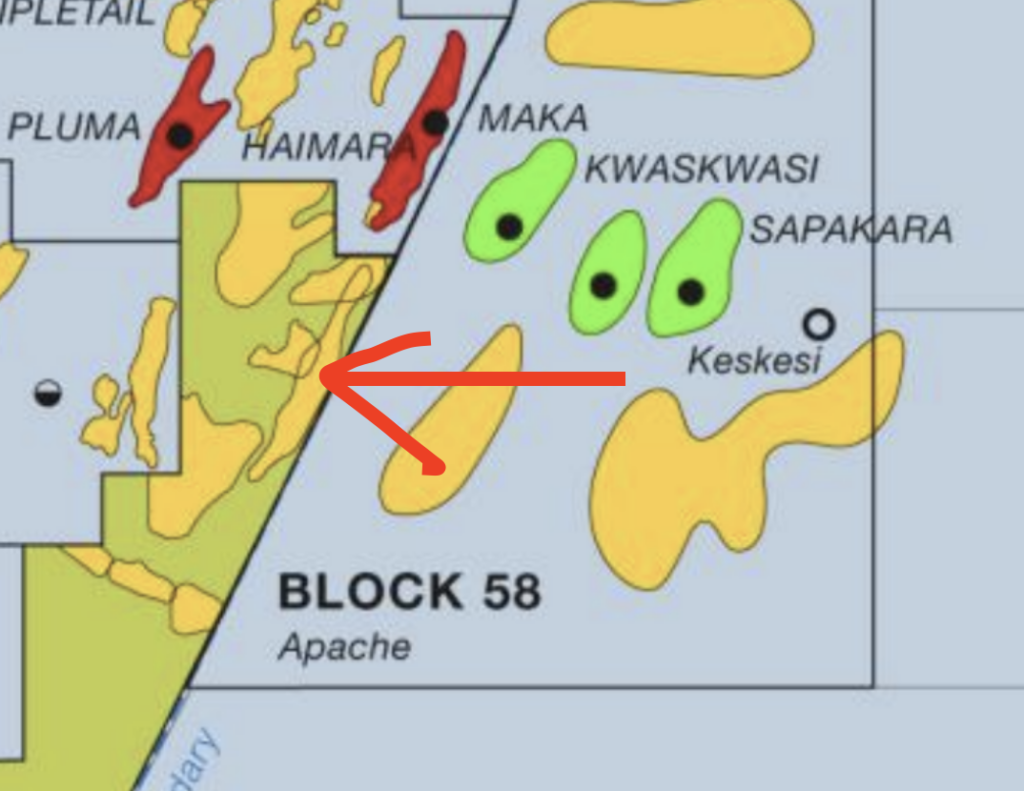

Now let me show you where CGX’s block is. The green area belongs to CGX (effectively Frontera). Picture tells all, have a good evening!