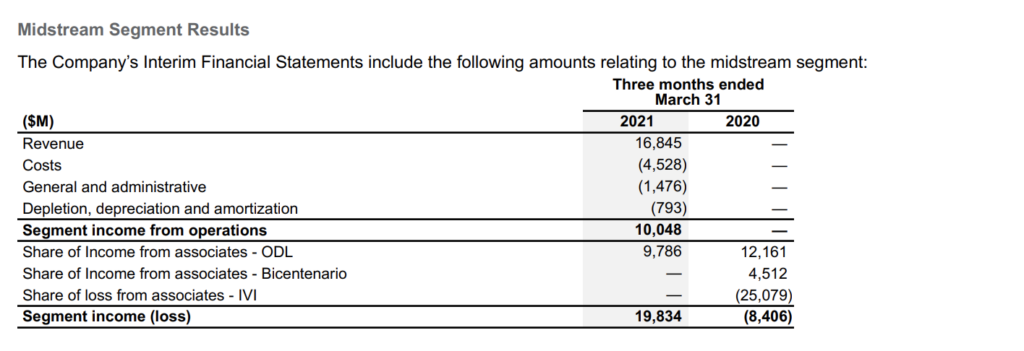

Frontera, despite reporting a loss in Q1 2021, if you read closely in MD&A and Financial statement, you’d notice that they have a lot of income generated from its midstream asset – $19 million USD in Q1. This is not part of OPERATING EBITDA.

ODL

- Share of income – $9.8 million

- Dividends Receivable – $28.8 million

For the three months ended March 31, 2021, the Company recognized $9.8 million as its share of income from ODL which was

source: https://www.fronteraenergy.ca/content/uploads/2021/05/FEC-MDA-Q1-21.pdf

$2.4 million lower than the same period of 2020 primarily due decrease in the transportation tariff since the second quarter 2020

and impact of foreign exchange fluctuations. During the three months ended March 31, 2021, the Company recognized gross

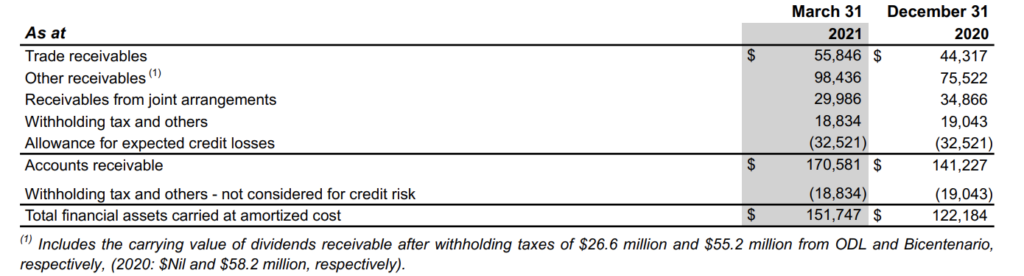

dividends of $41.6 million and a return of capital of $4.2 million. As at March 31, 2021, the Company has accounts receivables of

$28.5 million of dividends and return of capital contributions.

During the three months ended March 31, 2021, the Company recognized gross dividends of $41.6 million, (2020: $24.5

source: https://www.fronteraenergy.ca/content/uploads/2021/05/Frontera-FS-Notes-Q1-2021.pdf

million) and received cash dividends of $9.0 million, (2020: $38.7 million). As at March 31, 2021, the carrying value of

dividends receivable after withholding taxes is $26.6 million (2020: $Nil). In addition, during the three months ended March 31, 2021, the Company recognized a return of capital of $4.2 million, (2020:$Nil) and received in cash $2.0 million (2020: $Nil).

Puerto Bahia

Operating income: $10 million

For the three months ended March 31, 2020, prior to the acquisition of a controlling interest in Puerto Bahia on August 6, 2020,

source: https://www.fronteraenergy.ca/content/uploads/2021/05/FEC-MDA-Q1-21.pdf

the Company had recognized $25.1 million as its share of losses from IVI mainly due to higher unrealized foreign exchange

losses on the revaluation of Puerto Bahia’s USD-denominated bank debt. For the three months ended March 31, 2021 Puerto

Bahia has generated $10.0 million of segment operating income primarily from take-or-pay contracts in its liquid bulk storage

terminal business.

Bicentenario

Are they actually going to receive their dividends?